- Menu

- Skip to right header navigation

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Policies & Codes

Grievance Redressal

We at Edelweiss Retail Finance Limited (“ERFL/Company”) are committed to serve to make our client’s experience a rewarding one at our Company. ERFL’s Grievance Redressal Mechanism articulates our objective to minimize instances that give rise to customer complaints and create a review mechanism to ensure consistently superior service behavior.

We ensure prompt redressal of all complaints and use it for effecting necessary changes to improve the services further. In case of any complaint/grievance, the borrowers / customers including the applicants with disability (ies) may contact through any of the following channels.

First Level: The borrowers can directly approach the Branch Manager and enter his/her complaint/grievance in the compliant register maintained at the branch. The concerned Branch Official shall guide the borrowers who wish to lodge a complaint. The borrower may also lodge complaints / grievances at the following email id : assistance@eclf.com

Second Level: The borrower / customer can also approach Grievance Redressal Officer at the following address :-

Mr. Ragvan TR

Ground Floor, Tower 3, Wing B, Kohinoor City Mall, Kohinoor City, Kirol Road, Kurla(W), Mumbai – 400070

Email id: grievances@eclf.com

Grievance Redressal Officer shall endeavor to provide the borrower / applicant with the resolution / response to the queries / complaints / grievances received as earliest as possible.

Third Level: If the Complaint / Grievances is not resolved within a period of one month, the borrower / customer / applicant may appeal to :-

The Officer – in – Charge

Department of Non – Banking Supervision

Reserve Bank of India 3rd Floor, Near Maratha Mandir, Byculla, Mumbai Central, Mumbai – 400008;

Tel: +91 22-23084121 / 23028436

Fax: +91 22-23022011

Email id- dnbsmro@rbi.org.in

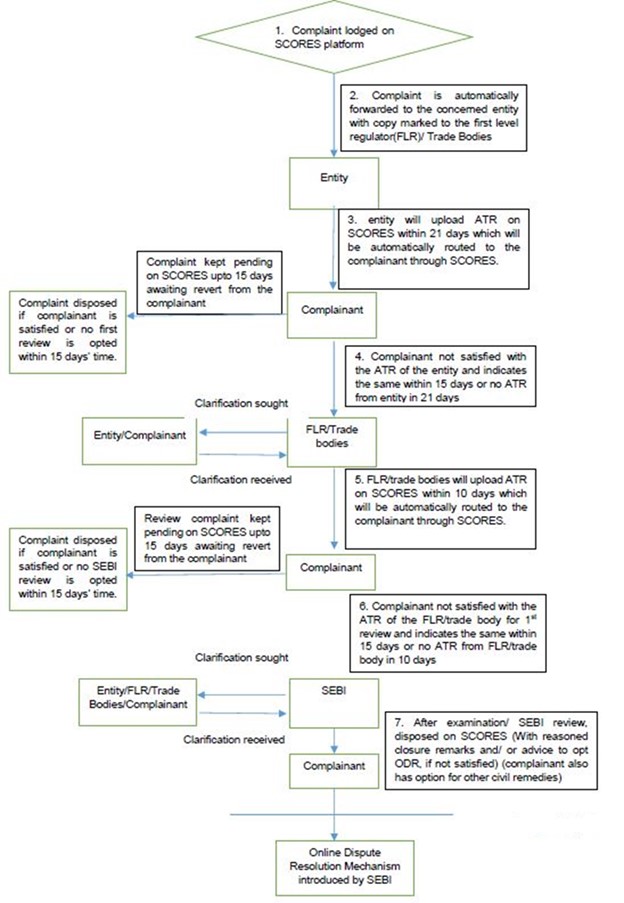

Grievance Redressal Mechanism – Investors

In case of any complaint/grievance, the investors may contact through the following channels:

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Level 4

|

|

Fair Practice Code & Ombudsman Scheme

Footer

Media & Press

- Zee News – How to make access to funds easier for MSMEs

- Economic Times – A primer for availing MSME business loans

- Mehernosh Tata, Head – SME Lending, Edelweiss Finance discusses how big data is going to be a lifesaver for SMEs

- SME World – Access to credit is key to empowering MSMEs says Mehernosh Tata, Head – SME Lending, Edelweiss Finance

- Banking Frontiers – Mehernosh Tata, Head – SME Lending, Edelweiss Finance says we have been at the forefront of testing & adopting several digital initiatives

Useful Links

- Home

- About Us

- Tools and Calculator

- Interest Rate, Fees and Charges

- Online Access

- Contact Us

- Download Document

- Special Offers

- Benchmark Rates

- Ex-gratia Payment Scheme

- Covid 19 – Moratorium

- Digital Partners

- List of Terminated Service Providers

- RBI-NPA-Circular November 2021

- Property Sale

- Secured assets possessed under the SARFAESI Act, 2002